China’s support for Russia has been hindering Ukraine’s counteroffensive

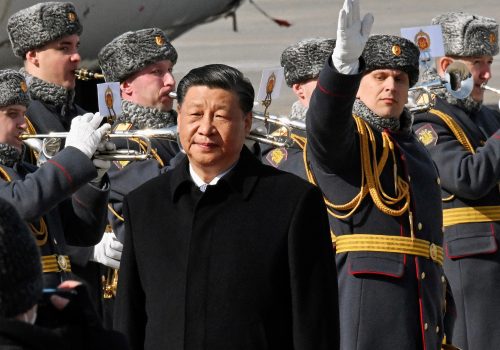

Last month, Russian President Vladimir Putin visited Beijing to meet with his Chinese counterpart, Xi Jinping, as Ukraine’s counteroffensive against Russian invaders stalled. Commentators have frequently pointed the finger at Ukraine’s military or its Western supporters for insufficient armaments deliveries to Ukraine. But it is important to acknowledge another vital factor behind Ukraine’s struggle to regain its land—the People’s Republic of China’s (PRC) economic lifeline to Russia.

Open-source trade data suggests that a surge in imports of Chinese-manufactured goods with important military uses played a key role in Russia’s ability to shore up its defenses on Ukrainian territory and to keep them equipped and supplied to resist the counteroffensive. Russia successfully transitioned to a defensive posture after the culmination of its offensive, dug in on Ukrainian territory, and has managed to sustain its forces there—despite continuing heavy losses of military equipment and tremendous expenditures of munitions. Even as weapons and ammunition pour into Ukraine from NATO countries, they are being counterbalanced by Chinese imports—not of weapons, but of materials vital for Russia’s ability to sustain its continued stubborn efforts to hold onto Ukrainian territory.

Though the PRC, as far as is possible to tell, has still not crossed the red line of providing significant amounts of “lethal aid” directly to Russia, openly available trade data makes it clear that the PRC is providing massive volumes of manufactured goods and technologies vital to Russia’s war effort. The vast majority of what has been included in this vital sustainment for Russia’s military machine is being provided openly, and is not prohibited or restricted by the international sanctions regimes in place against Russia. It is “legitimate trade” and, although Beijing is doing nothing to discourage the trade, it is likely not even centrally orchestrated. To what extent Beijing is ensuring this flow to Russia, as opposed to simply allowing it, is unclear. What is clear is that what is being provided is vast in scope and very relevant for Russia’s war effort.

Chinese-made digging and dirt-moving equipment has—literally—helped Russia entrench its forces in the Ukrainian territory it occupies. A massive increase in vehicle imports, including in super heavy trucks, has likely enabled Russia’s war industry to continue producing military vehicles that are key to maintaining combat power for a defense in depth. These Chinese vehicles also enable Russian military logistics to keep equipment and supplies moving to the front.

A huge surge in ball bearing imports from the PRC, meanwhile, has also likely enabled the production of tanks. Finally, the continued flow of silicon chips from the PRC has provided key components for Russia to restore its weapons production, enabling Russian artillery, missiles, and drones, for example, to continue raining destruction on Ukrainian counterattack forces and civilian targets alike.

Taken together, all these materials have allowed Russia to put up an effective, resilient, and multilayered defense against Ukraine’s counteroffensive. Take these away, and it is questionable at best whether Russia could have sustained its defense in depth of occupied Ukrainian territory.

The equipment to build the Surovikin Line

Chinese vehicle exports to Russia may have prevented a catastrophic defeat for Russian military forces. During August and September 2022, Ukraine enjoyed successes in rolling back the Russian invasion, especially around the city of Kharkiv. Facing disaster, Russian forces began to assume a defensive posture. They constructed the so-called “Surovikin Line” (named for the Russian general who led the effort) of trenches and other defensive fortifications.

Chinese excavator exports to Russia more than tripled in September 2022 when compared to prior-year levels and coincided with the construction of the Surovikin Line.

While excavators dig from the subsurface, front-end shovel loaders help to clear dirt on the surface. Both of these machine types made it to the front lines, as a Wall Street Journal investigation found, helping Russian forces to entrench themselves.

Russia’s civilian construction season lasts from approximately March through October. However, Chinese shipments to Russia of trench-digging equipment were highly elevated from September 2022 and remained high throughout the remainder of the winter, only to decline sharply after Ukraine launched its June counteroffensive. The unseasonal imports of trench-digging equipment, outside of the civilian construction season, is further evidence that these materials were used for military purposes.

Drones, and parts for tanks and fighter jets

As the work of Thane Gustafson of Georgetown Universty shows, ball bearings are a vital input for military tanks and railcars. Russia has traditionally sourced its ball bearing needs from the West. Due to sanctions, however, Russia is increasingly turning to lower quality ball bearing imports from the PRC, both directly and indirectly.

Chinese year-to-date total exports of ball bearings to Russia are up 345 percent from the same period in 2021. Chinese exports to Kyrgyzstan, meanwhile, are up 2,492 percent.

While it’s possible that Kyrgyzstan’s domestic market suddenly requires ball bearings, the much more likely explanation is that these products are immediately re-exported to Russia, perhaps to suppress top-line trade totals or to establish cutouts to avoid future sanctions.

Russian annual tank production has doubled from pre-war levels and now stands at two hundred tanks, according to recent reporting from the New York Times. Chinese exports of ball bearings are likely directly or indirectly facilitating the surge in Russian tank production, although we cannot prove this definitively.

While Chinese-made ball bearings are of lower quality than their Western equivalents, they are sufficient to sustain Russia’s armed forces in this phase of the war. Russia’s tanks are being employed for less demanding tactical tasks than earlier in the war, limiting their need for premium components. Whereas tanks in the first phase of the conflict were employed for rapid and sustained offensive maneuvers over long distances, they are now being employed primarily for largely static defensive purposes and local counterattacks, reducing maintenance strain.

Furthermore, Chinese-made drones are finding their way to Russia. A Radio Free Europe/Radio Liberty investigation found that Chinese commercial dronemaker DJI’s products are being sold to entities affiliated with the Russian military-industrial complex. Finally, as the US intelligence community has documented in publicly available reporting, the PRC has also been providing key high-tech components with military applications, including avionics and fighter-jet engine parts that have clear military value.

Truck exports and logistics

Large-scale Russian imports of Chinese-made trucks are helping sustain Russia’s war effort in Ukraine. With Russian occupation forces largely unable to utilize rail or seaborne transit for resupply, they rely on trucks for their supply lines, which Chinese exporters have provided.

Chinese year-to-date exports to Russia of very large trucks weighing greater than twenty tons were up by 728 percent from 2021 levels in the first eight months of this year.

Similarly, Chinese exports to Russia of “tractors”—that is, vehicles with compression-ignition internal combustion piston engines (diesel or semi-diesel)—were up from zero in 2021 to nearly 48,000 units through September 2023.

The PRC’s truck exports are providing critical assistance to the Russian war effort. KAMAZ, the Russian heavy duty truck manufacturer, has been sanctioned by the US Treasury Department. Chinese truck imports have likely allowed KAMAZ and other automakers to shift production lines to serve Russia’s military needs for armored vehicles and other kit.

Electronic components

Following the release of April 2023 trade data, we reported that the PRC had already more than doubled its 2021 exports of integrated circuits to Russia, without accounting for indirect shipments. Since that report, the numbers continue to outperform the pre-war period. In just nine months of data released so far in 2023, the PRC’s total direct exports of integrated circuits to Russia have already far surpassed total annual pre-war levels. The timing and extent of this surge strongly suggests a direct linkage to war production requirements.

These integrated circuits contribute to sustaining Russia’s war production despite international sanctions. It is difficult to control the trade flows of civilian microelectronics with military applications, and it is these dual-use items in particular that Russia takes advantage of, according to Sam Bendett, an advisor at the Center for Naval Analyses. As reported by the news outlet Semafor, the Ukrainian military has found a considerable number of electronics produced in the PRC in Russian weapons captured on the battlefield. Among these examples of Chinese parts used in lethal weapons, Semafor points to a Russian cruise missile, while Reuters reveals cases of Chinese parts found in Russian tanks and Orlan aerial drones that previously used French and Swiss products, respectively.

Beyond Chinese-made electronics, the PRC is also exporting Western-made components with military uses to Russia. According to the Kyiv School of Economics Institute’s research, Western-made components account for most of the dual-use technology Russia imports from the PRC, and the PRC is the dominant intermediary for Russian imports of semiconductors manufactured elsewhere.

The big picture

Some will question the central positioning of the PRC in this analysis, pointing to the leakage of sanctions, and to other countries as sources of materials fueling Russia’s war machine. Are other countries continuing to export to Russia in militarily relevant sectors, some even in violation of sanctions? Certainly. However, none are providing these key materials at anywhere near the same scope and scale, and certainly no other country would be willing and able to meet the massive requirements of maintaining Russia’s war effort at this point.

Reasonable people can differ over what is behind this, how much Xi and the Chinese Communist Party are abetting Russia’s war, and what the policy response should be from the United States. But the United States, NATO, and their allies and friends around the world should be absolutely clear in their understanding that materials manufactured in and shipped from the PRC are counterbalancing the flow of weapons and equipment to Ukraine. The PRC may still not be directly providing weapons to Russia, but it is providing materials and equipment that helps sustain Russia’s war and its occupation of Ukrainian territory.

Preventing future flows of goods to Russia that can help fuel the Kremlin’s war machine is a challenging problem. The United States, its allies, and its partners should, of course, eliminate leaks in their own sanctions regimes, tightening enforcement of export controls across Europe, North America, and the Indo-Pacific. Countering Chinese dual-use exports to Russia is a more difficult problem, given the size of the Chinese economy, Beijing’s hostility to the Washington- and Brussels-led international order, and the complex risks facing constitutional democracy. Existing US and European Union sanctions and export controls do not provide the legal authority or the tools to directly affect most of this trade, so curtailing the flow of dual-use exports from the PRC to Russia would require either novel mechanisms on the part of the West or influencing Beijing to use its own levers to restrict the flow.

Ultimately, however, this problem must first be better and more widely understood before it can be more effectively managed and perhaps even solved someday. The United States and all other countries that wish to see Russian forces ejected from Ukrainian territory must all come to grips with the unfortunate reality that, as long as the PRC’s support for Russia continues, it is likely to remain a key obstacle to Ukraine’s ability to re-establish control over its territory. If Ukraine’s supporters in Washington, Brussels, and around the world do not collectively come to recognize the PRC’s role in this war as a vital sustainer and enabler of Russia’s military, there is little hope they will ever be able to muster the level of policy focus and political capital that it would take to curtail or overcome that support.

Markus Garlauskas is the director of the Indo-Pacific Security Initiative at the Scowcroft Center for Strategy and Security and a former senior US government official with experience as an intelligence officer and strategist.

Joseph Webster is a senior fellow at the Global Energy Center and editor of the China-Russia Report.

Emma C. Verges is a program assistant with the Indo-Pacific Security Initiative.

Further reading

Mon, May 8, 2023

China’s support may not be ‘lethal aid,’ but it’s vital to Russia’s aggression in Ukraine

New Atlanticist By Markus Garlauskas, Joseph Webster, Emma C. Verges

A close look at trade data shows that Beijing is already providing critical support for Moscow’s war aims. Policymakers should not get hung up on the “lethal aid” red line.

Tue, Oct 31, 2023

ATACMS missiles create new dilemmas for Russian army in Ukraine

UkraineAlert By Mykola Bielieskov

Two weeks since Ukraine’s President Zelenskyy first confirmed delivery of ATACMS missiles from the US, reports continue to mount of highly destructive ATACMS strikes against the Russian army in Ukraine, writes Mykola Bielieskov.

Thu, Oct 26, 2023

Arming Ukraine is cheap compared to the far higher price of Russian victory

UkraineAlert By Peter Dickinson

Anyone concerned by the cost of supporting the Ukrainian war effort should consider the far higher price the Western world would have to pay in order to stop Putin following a Russian victory in Ukraine, writes Peter Dickinson.

Image: QINGDAO, CHINA – JUNE 14, 2023 – Three workers walk past a truck yard at a heavy industry company in Qingdao, Shandong province, China, June 14, 2023. The company produces excavators, loaders, mining cards and other road machinery products have been exported to Russia, Central Asia, Southeast Asia and Africa and other countries and regions. (Photo by CFOTO/Sipa USA)